Set a Goal

If you know your financial goals, you can define a framework for investing. In this case, it is important to develop a successful strategy and follow it. When you plan for a long-term goal, you may be tempted to use it ahead of time. For example, you're saving for retirement, but it's still decades away. The most popular investment options:

1. real estate

2. gambling

3. cryptocurrency

4. finance

Accordingly, you may be tempted to use the funds in case you lose your job. To avoid the temptation, you need to create a goal and stick to it.

Potential Income Increases Risk

The possibility of a high income is always attractive. Such an advantage usually comes with a risk. It is always better to choose investments that are not as risky, even if the return will not be very high. All investments have risks anyway. Consider the likelihood of losing more than you invest. Determine when the risk is really justified.

Determine Investments

In investing, you don't have to mix everything in one pile. This is very important, especially for beginners. Learn to allocate money to different assets, taking into account geographic regions. This way, you won't have to depend on investments in a particular region. If one investment fails, the loss can be covered by other investments. In this case, there are no guarantees either.

Investing for the Long Term

Never consider investments as a way to get rich quickly. It usually takes at least 5 years to get a justifiable return from your investment. During this time, income can really increase. Consider important nuances:

- possible risks;

- invest in different regions;

- stick to the strategy.

Regardless of which way you choose to invest, be prepared to take risks. Your money must be available easily.

Useful Tips

Always watch out for speculative investments that initially seem too attractive. Don't chase what's right and what's left. Analyze your actions well. Don't make investments just because others do.

There's a great example. In 2017, many investors put a lot of money into the well-known digital currency Bitcoin. Its value went up at the time, but within a month it had fallen by half. Until 2018, the value of bitcoin was only going down.

Don't Invest in Things You Don't Have Experience in

Before investing money, you should take the time to study all the detailed information. It is very important to understand all possible risks. There are different funds for investors that explain all the necessary information. You should be sure to familiarize yourself with the basic rules before making an investment.

If your investments are related to individual companies, you need to find out all the information about the company. It is also important to understand how the company plans to increase income.

Fee Factor

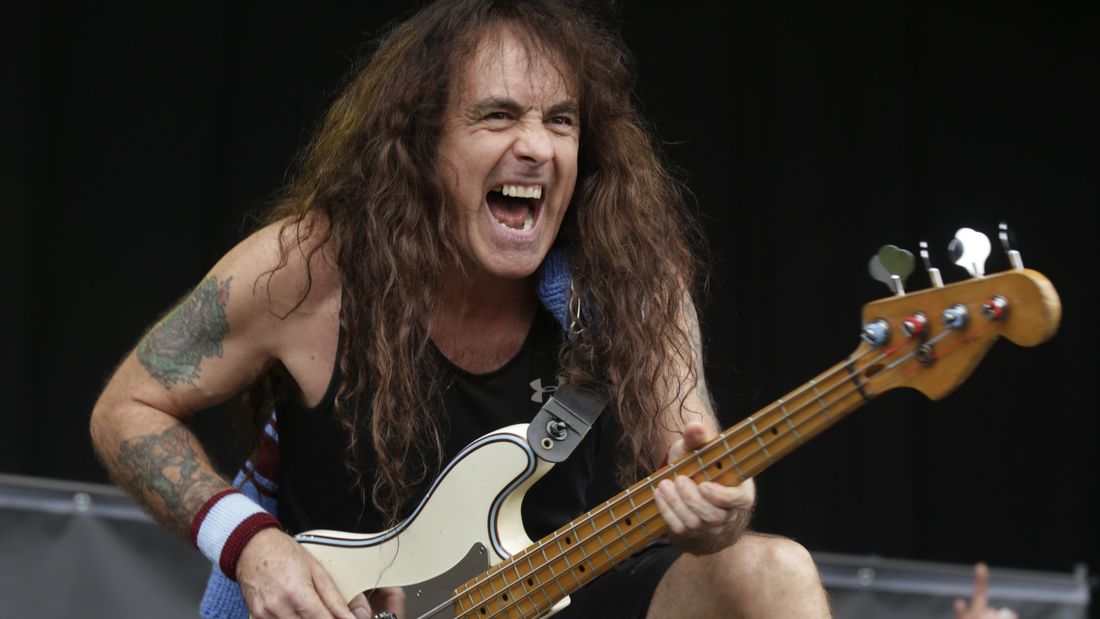

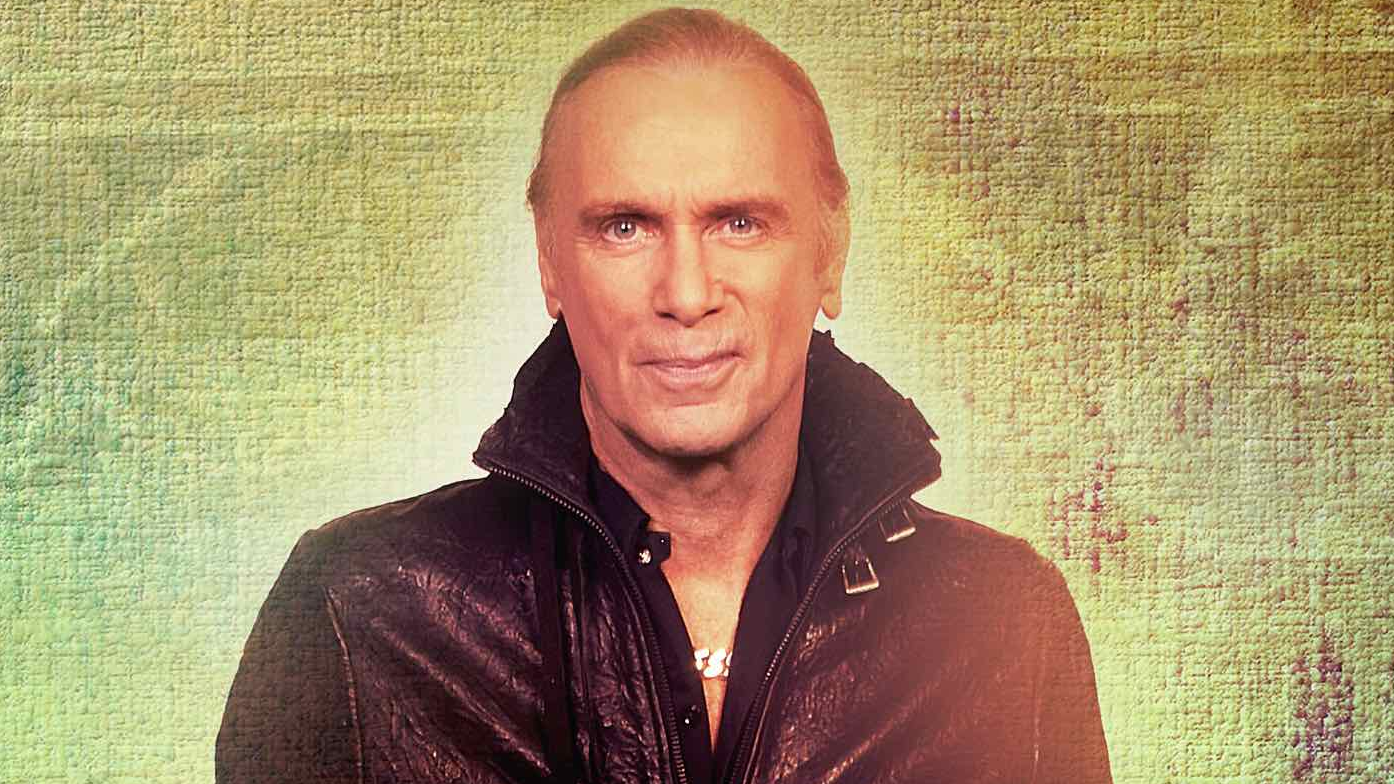

When you make an investment, keep in mind that fees affect your profits. This information is especially important when choosing an investment. Many people invest in online casinos. There are a lot of options for making a profit. For example, at casino Slots Empire, you can gamble online or choose an affiliate program.

In this option, you have to think carefully about your spending in order to really make a profit. Choose reliable online casinos and play responsibly.

How to Increase Profits?

When you plan to make investments, you are always interested in how to increase your income. There are many nuances in this business that affect the increase in your overall return. Your income generates income. In investing, this is more familiar as compound interest.

Always bear in mind that reinvesting income means that you may experience a loss or some reduction in value. If the income you receive is automatically reinvested, it's not very profitable. Usually you can't choose the price of the stock and therefore take a lot of risk.

Don't Pay Too Much Attention to Market Definition

If this is the first time you've decided to invest, don't study the market completely. Focus on what you know best. There is no perfect time to buy an investment before it goes up in value and sell it before it goes down in price. No one can say with certainty how the stock markets will move in the future.

If you constantly obsess about which direction the stock markets are moving, you run the risk of buying or selling investments at the wrong time. When you're planning to do investments, especially in the long term, always make thoughtful and balanced decisions. Emotional and panicky decisions have no place in this business.

Check the Portfolio

When you choose investments, it always drags on for a long period of time. At the same time, you should not forget about your investments. The value of investments can change over time, due to many factors. Allocate your assets correctly. This applies to obligations and cash.

Periodically, you need to check your portfolio and rebalance it. You need to walk confidently to your goal and make sure you are on the right path to achieve your goals. Constantly check for up-to-date information related to your investments.

Summary

To get a passive income many people choose investing. You can find out what it is at this link https://en.m.wikipedia.org/wiki/Investment. This is a great way to increase your profits in the long run. If you're a newcomer to the pack, be sure to check out these helpful guidelines. The top 10 rules will help you understand how to make better investments. Choose the best suggestions for increasing your profits and investing. One option may be the gambling industry.